Binance, the world’s largest crypto exchange by volume, is being tested by a wave of large outflows as traders seek to withdraw their coins.

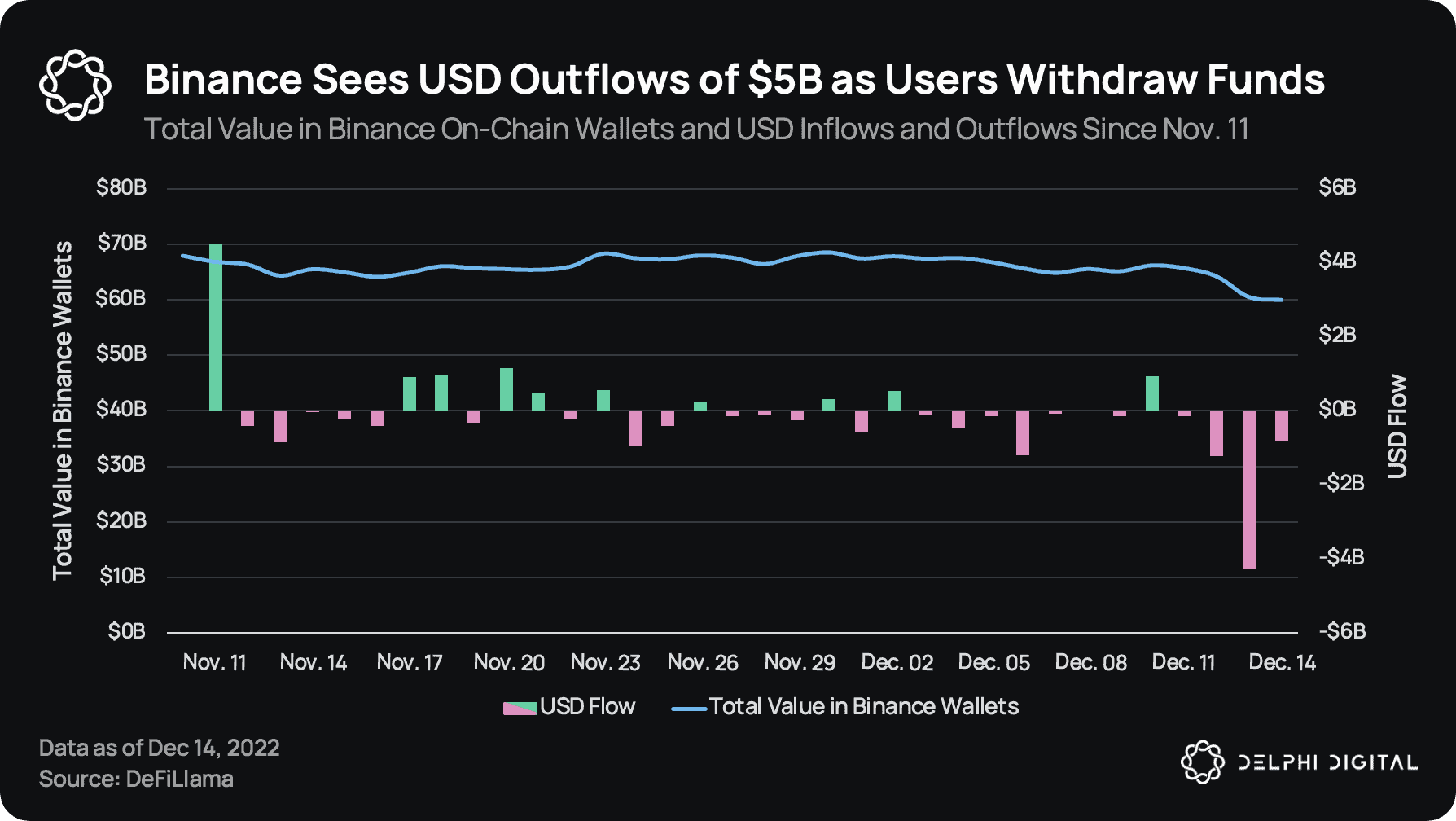

According to crypto insights firm Delphi Digital, Binance saw over $5 billion in net outflows on December 13th and 14th.

Delphi Digital says that the big withdrawal flows could stem from the collapse of FTX and the lower levels of trust in crypto exchanges that has followed.

“Binance saw more than $5B of net outflows between December 13th & December 14th.

This is the largest 2-day outflow since the exchange started providing proof of reserves on November 10th.

As U.S. Congress holds hearings over the FTX collapse, concerns regarding Binance have been growing, leading to an increase in withdrawals.”

Binance has offered a proof-of-reserves report showing that all of its customers’ assets are backed 1-1, and had it looked over by global auditing firm Mazars. However, Mazars recently took down its audit of Binance and reportedly cut ties with the crypto industry.

The firm stated,

“Mazars has paused its activity relating to the provision of ‘Proof of Reserves Reports’ for entities in the cryptocurrency sector due to concerns regarding the way these reports are understood by the public.”

Binance CEO Changpeng Zhao (CZ) has maintained that all assets on the exchange are one-to-one backed.

“People can withdraw 100% of the assets they have on Binance. We will not have an issue on any given day. So 100% of users withdraw 100% of assets, we’d be fine.

This is very different for traditional financial people to understand because banks run on fractional reserves, and the traditional regulators, many of them may think that it is okay for crypto businesses to be running on fractional reserves. That is not okay. In crypto, there’s no central bank printing money to bail out banks when there’s a liquidity crunch. So, crypto businesses have to hold user assets one-to-one and that’s what we do. It’s very simple.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.