Popular crypto analyst InvestAnswers says that an on-chain signal is suggesting that Bitcoin (BTC) is way overdue for a rally.

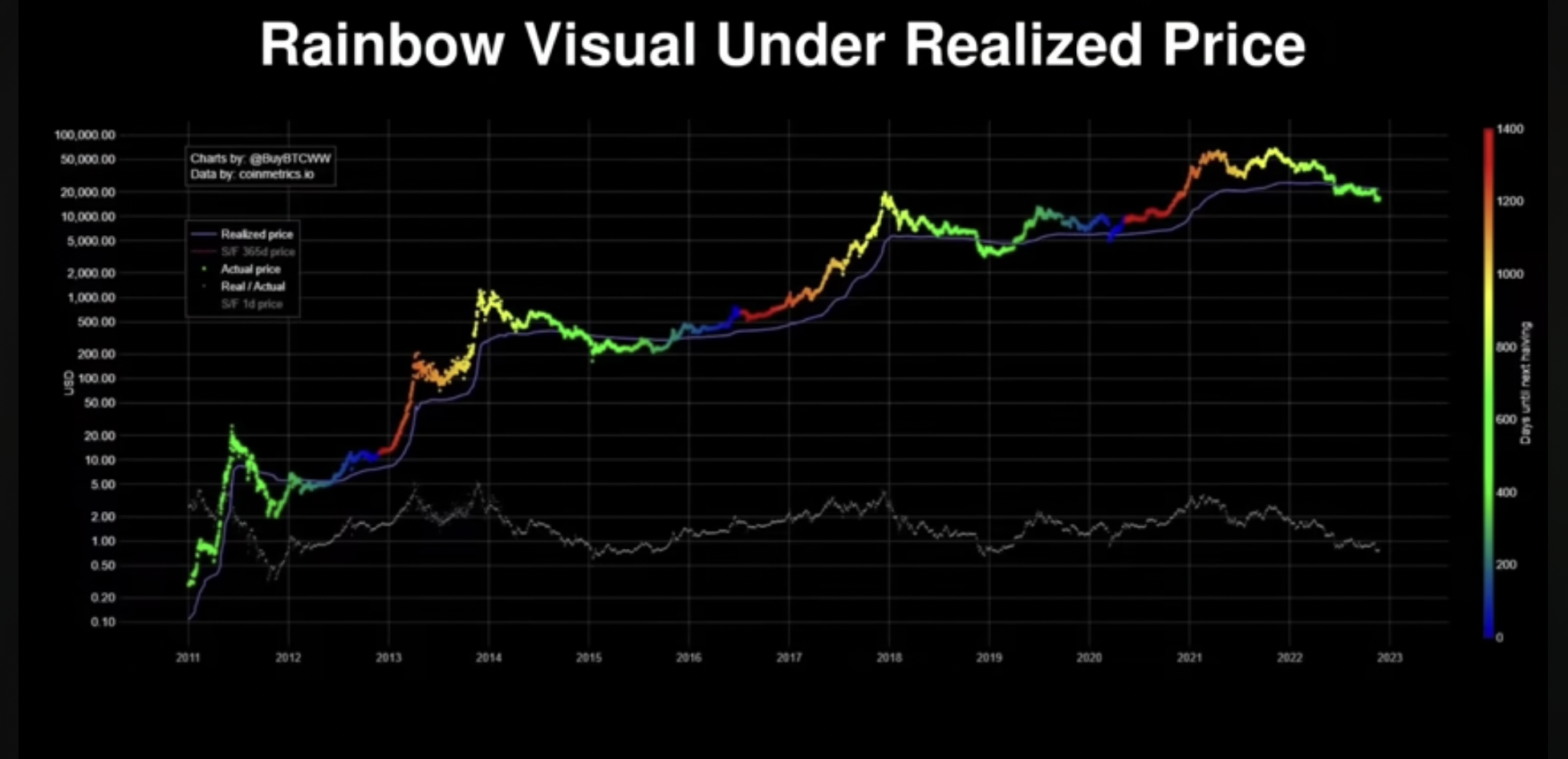

In a new strategy session, the pseudonymous analyst takes a look at Bitcoin’s realized price (RP) metric, which records the value of all BTC at the price they were bought, divided by the number of coins in circulation.

The analyst points out that historically, BTC has not stayed below the RP for long.

“We’re counting down to the next halving and here we’ve been under the realized price… it’s now 170 days and the actual price is under that RP of about $21,000, suggesting an upswing in the actual price is on the cards because we don’t stay down here that long, at least many believe…

This is a rainbow visual of the realized price. And you can see how the Bitcoin price is pretty much, most of the time, above the RP… It’s to the tune of like 97% of the time, 98% of the time it’s above that. Now it’s below. Now the question is, how does that shape up in history?”

According to the analyst, Bitcoin stayed below the RP for 110 days in 2011, 240 days in 2015, 115 days in 2018, 8 days in 2020 and 170 days so far in 2022, implying that a BTC bounce could be approaching.

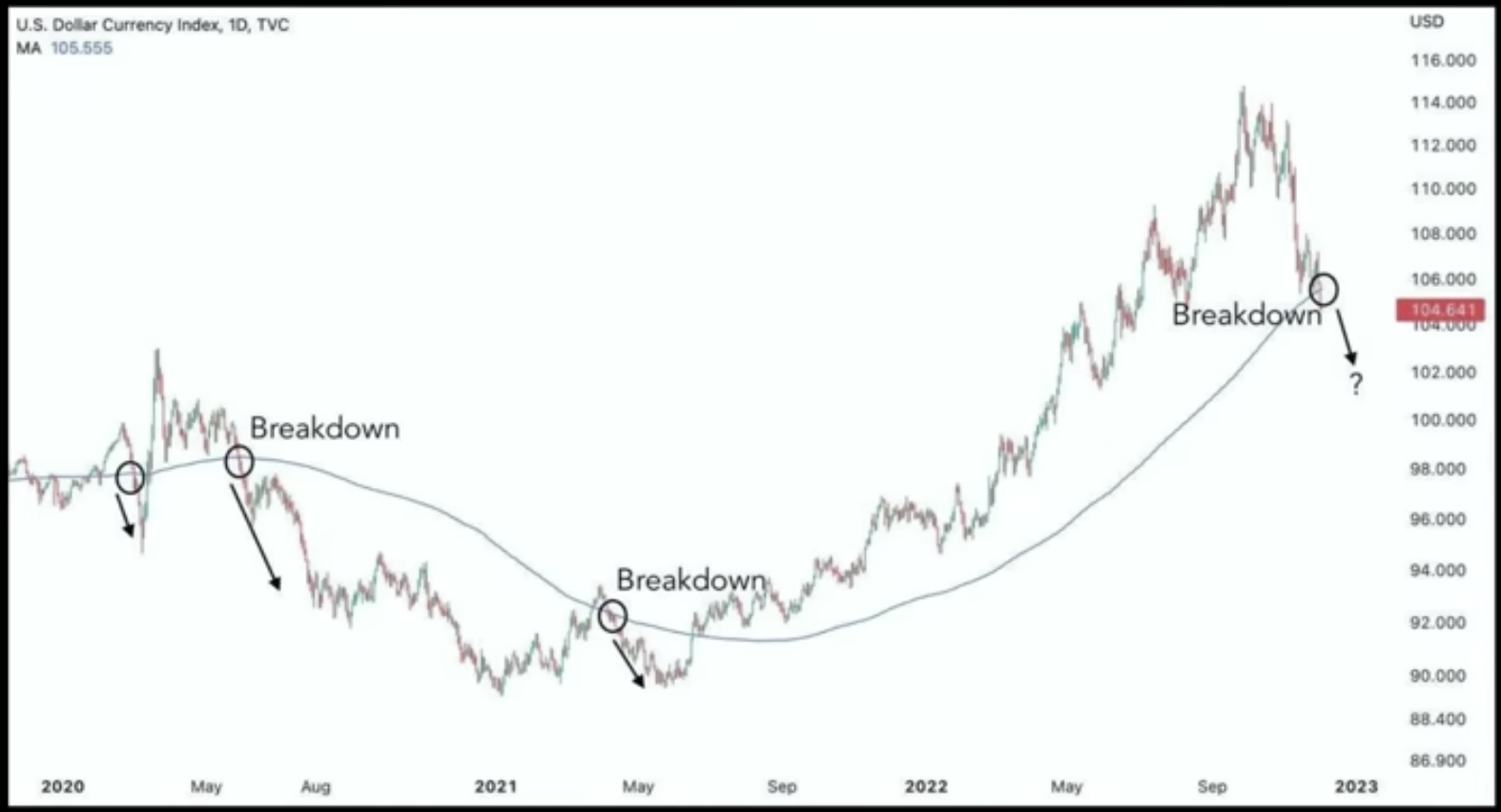

Also suggesting that Bitcoin is ready for a rally is the increasing weakness in the US dollar index (DXY), says the analyst. DXY is the USD versus a basket of other major fiat currencies and is traditionally thought to be inversely correlated to risk-on assets like Bitcoin and crypto.

“This is a pretty cool sign because as we know, as DXY goes up, Bitcoin goes down, and vice-versa. They are inversely correlated. If history repeats – and we’ve said that a lot lately – this chart signals a possible breakdown. But you could also argue it already has broken down from 115 down below 109. But here we are again. If this does happen, this will be very good for the risk-on space as well.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.