When creating a new cryptocurrency, you can choose to make a coin or token. A coin has its own blockchain, while a token is built on a pre-existing network. Cryptocurrencies rely on blockchains for their security and decentralized nature.

Creating a token requires less expertise and effort than making a crypto coin. A coin will usually need a team of developers and experts to make it. A token still needs technical knowledge, but it's possible to create them in minutes through the use of other blockchains, such as Ethereum, Binance Smart Chain, Solana, and Polygon.

Your choice of a token or coin will change depending on the customizability and utility you want. Overall, the costs involved depend on the work needed, like external developers and time.

Ethereum and Binance Smart Chain are popular blockchains for creating digital currencies. You can either use established code to create tokens yourself or pay to use a coin creation service. Sidechains are another popular choice as they provide more customization with the main blockchain’s benefits.

Before creating your own crypto, you'll need to consider its utility, tokenomics, and legal status. After this, your choice of blockchain, consensus mechanism, and architecture are all needed for the development stage. Next, you could consider an audit of your project and a final legal check. While pretty much anyone can create a cryptocurrency, developing a solid project requires serious work and dedication.

The idea of creating your own cryptocurrency, use cases, and audience is an exciting one for many crypto fans. But where is the best place to start? There are actually many ways to create coins and tokens. The costs and knowledge also vary based on the complexity of your project. If you're thinking about creating your own cryptocurrency, our article lays out the very basics for you to get started.

A cryptocurrency, also known as crypto, is a type of digital asset with multiple use cases. It's primarily a way to transfer value between people digitally, including monetary value, ownership rights, or even voting privileges. Crypto differs from other digital payment systems because of its roots in blockchain technology. This basis gives cryptocurrencies more freedom from central entities like governments or banks.

Bitcoin is the most famous example of a cryptocurrency. It has a simple use case of transferring monetary value to anyone across the globe without the need for intermediaries. Its blockchain records all transactions and ensures security and network stability.

Cryptocurrencies can roughly be split into two categories: coins and tokens. The difference between them is simple. Coins have their own native blockchain, like Bitcoin, for example. Ether (ETH) has the Ethereum blockchain. Coins typically have a specific utility over the whole network, like paying for transaction fees, staking, or taking part in governance.

Tokens are built on pre-existing blockchains. They might have some similar roles to coins, but tokens mainly have utility in their own projects. One example is PancakeSwap's CAKE on Binance Smart Chain. You can also use it to pay for certain transactions in the PancakeSwap ecosystem, like minting Non-Fungible Tokens or playing their lottery. However, CAKE doesn’t have its own blockchain, so it cant be used in every application across BSC. The same is true for the thousands of ERC-20 tokens issued on the Ethereum blockchain. Each token is part of a specific project with different use cases.

As mentioned, creating a token is much simpler than creating a coin. A coin requires you to develop and successfully maintain a blockchain. You could fork (create a copy) another existing chain, but this doesn't solve the problem of finding users and validators to help your network survive. Nevertheless, the potential for success with a new coin can be higher than just making a token. Here's a basic overview of the two options:

|

Coin

|

Token

|

|

Runs on its own blockchain network

|

Can be built on existing blockchains with an established user base

|

|

Requires advanced blockchain knowledge and coding skills

|

Fairly simple to create with pre-existing tools and open-source code

|

|

Blockchain development is more costly and takes time

|

Token development is faster, simpler, and relatively cheap

|

Creating a coin

Creating a new coin can take a lot of time if you develop your own blockchain. However, forking a previous blockchain can be done speedily and used as a base for your new coin. Bitcoin Cash (BCH) is one example of a forked project. To do this, you still need a high level of blockchain technical and coding knowledge. The success of your project will also rely on getting new users to your blockchain network, which is a challenge.

Creating a token

Creating a token on an existing blockchain can leverage its reputation and security. While you won't have complete control over all aspects of your token, there is still a lot of customization available. There are a variety of websites and tools available to create your own token, especially on BSC and Ethereum.

Should I create a coin or a token for my project?

A token will usually be enough for Decentralized Finance (DeFi) applications or play-to-earn games. Both BSC and Ethereum have a massive amount of flexibility and freedom for developers to work with.

If you're looking to push the limits of what a coin or blockchain does, creating a coin with its own blockchain would likely be better. Creating a new blockchain and coin is certainly harder than issuing a crypto token. But if done right, it can bring lots of innovation and new possibilities. Binance Smart Chain, Ethereum, Solana, and Polygon are good examples.

Still, both options will require a lot of hard work along with technical, economic, and market knowledge to succeed.

Some of the most popular solutions for creating cryptocurrencies are BSC, Ethereum, and Solana. Both these networks provide ways to make a variety of tokens based on pre-existing standards. BEP-20 and ERC-20 token standards are leading examples that almost any crypto wallet provider can support.

ERC-20 belongs to the Ethereum blockchain, while BEP-20 is part of the Binance Smart Chain (BSC). Both networks allow for the creation and customization of smart contracts that enable you to create your own tokens and decentralized applications (DApps). With DApps, you can create an ecosystem that provides more use cases and functionality to your token.

You could also look at sidechains that use the security of a larger chain like Ethereum or Polkadot but also provide some customization. The Polygon Network is attached to Ethereum and provides a similar experience but is cheaper and faster to use.

After picking a blockchain, you'll need a method for creating your token. With BSC and other blockchains that are based on the Ethereum Virtual Machine, the process is relatively simple. You can also find ready-to-use tools that create tokens based on the parameters and rules you provide. These are usually paid, but they are a more practical option for users not familiar with smart contracts.

If you want to make your own blockchain and coin, you will likely need a team of blockchain developers and industry experts. Even if you look at forking a blockchain like Ethereum or Bitcoin, there is still a huge amount of work required to setup your network. This would include encouraging users to act as validators and run nodes to keep the blockchain running.

Apart from the obvious choices like your blockchain or creating a coin or token, there are a few other key areas to consider:

Define your cryptocurrency's utility

Cryptocurrencies can play many roles. Some act like keys to access services. Others even represent stocks or other financial assets. To understand and map out the process of creating your crypto, you'll need to define its features from the beginning.

Design your tokenomics

Tokenomics are the economics that govern your crypto, like total supply, distribution method, and initial pricing. A good idea can fail if the tokenomics aren't correct and users aren't incentivized to purchase the cryptocurrency. For example, if you're creating a stablecoin but cannot peg it correctly, no one will want to buy or hold it.

Check its legal compliance

Countries around the world have their own laws and rules regarding cryptocurrencies. Some jurisdictions may even ban the use of cryptocurrencies. Consider fully your legal obligations and any compliance issues you might face.

If you're only creating a token, not every step in the tutorial below will apply. What's more important would be the three design steps above. Most of our instructions will cover the basics of creating a blockchain first before finally minting your coin.

1. Choose a suitable blockchain platform

For a token, you'll need to pick the blockchain to mint your crypto on. BSC and Etheruem are popular options, but sidechains can also be a good idea. To create your own coin, you'll need to think about designing or hiring someone to create a custom blockchain.

2. Pick a consensus mechanism

If you're creating your own blockchain or aren't sure which one to pick for your token, think about the consensus mechanism you want. These mechanisms determine how participants confirm and validate transactions on the network. Most blockchains use Proof of Stake as it has low hardware requirements and many different variations. Proof of Work, as used in Bitcoin, is considered by some as more secure but it’s often expensive to maintain and not as environmentally friendly.

3. Design your blockchain architecture

This step is only needed if you're creating a coin. Not every blockchain allows the public to validate transactions or run nodes. The decision between having a private, public, permissioned, or permissionless blockchain is important. Your blockchain architecture will depend on what your coin and project are attempting to do. For example, a company or country creating a coin might run a private blockchain for more control.

4. Begin blockchain development

Unless you have expert development knowledge, you'll need external help to build your ideas. Once the blockchain runs in a live environment, it's extremely difficult to change its core concepts and rules. Make use of a testnet to ensure that everything works as planned and ideally cooperate with a whole development team to build your blockchain.

5. Audit your crypto and its code

Auditing companies like Certik can check the code of your blockchain and its cryptocurrency to look for any vulnerabilities. You can then publish the audit publicly and also act on its findings. This process provides some safety assurance for you as the creator and for any potential users or investors.

6. Double-check legal aspects

Now that you have your blockchain running and are ready to mint your cryptocurrency, it's best to ask for expert legal advice to check whether you will need to apply for permission. Again, this step is difficult to achieve alone and requires outside help.

7. Mint your cryptocurrency

Whether you're creating a token or coin, you will need to mint the cryptocurrency at some point. The exact method will differ based on your tokenomics. For example, fixed supply tokens are usually minted all in one go via a smart contract. Coins like Bitcoin are minted gradually, as miners validate new blocks of transactions.

To create a simple BEP-20 token, you’ll need some basic coding skills to deploy a smart contract to Binance Smart Chain. You’ll also need to have MetaMask installed and some BNB in your wallet to pay gas fees.

1. Make sure you have the BSC mainnet added to MetaMask. You can find detailed instructions in our Connecting MetaMask to Binance Smart Chain guide.

2. Head to Remix, an online application for developing and deploying smart contracts on blockchains that are compatible with the Ethereum Virtual Machine. Right-click the [contracts] folder and click [New File].

3. Name the file “BEP20.sol”.

4. Make sure you have the programming language set as [Solidity], or your smart contract won’t function. You can do this by clicking the icon outlined below on the right.

5. Copy the BEP-20 smart contract code into your file. You can find out more information on the code’s parameters and functions on GitHub.

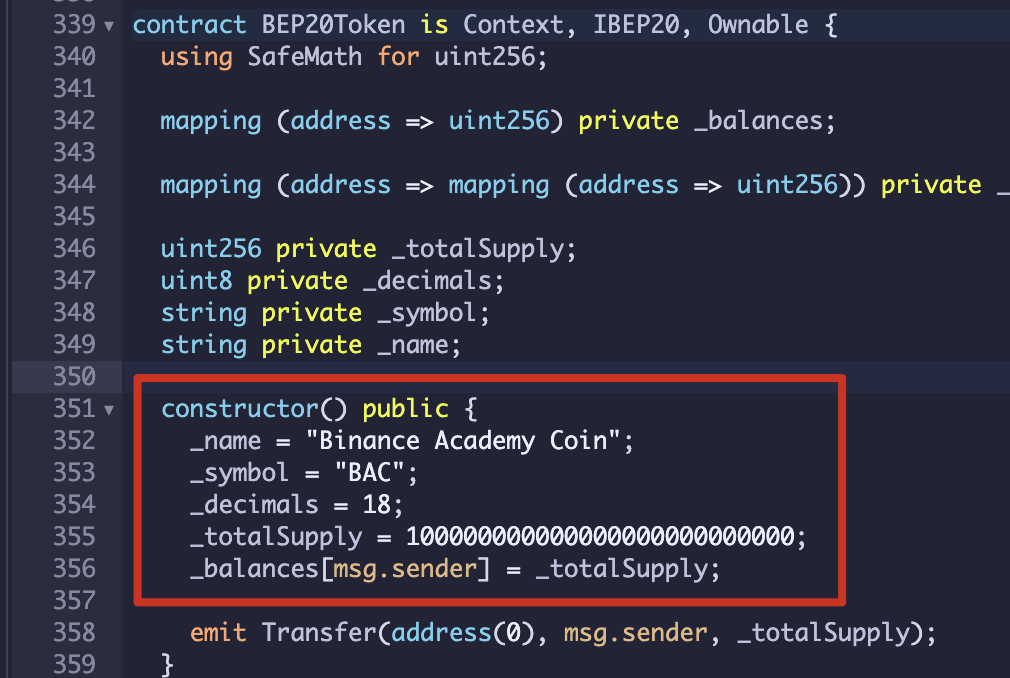

6. Modify the name, symbol, decimals, and totalSupply for your coin. Here we’ve chosen Binance Academy Coin (BAC) as an example, with 18 decimal places and a total supply of 100,000,000. Don’t forget to add enough 0s to cover the 18 decimal places.

7. Next, you’ll need to compile the smart contract. Click the icon shown below on the left side of the screen, check [Auto compile] and [Enable optimization], then click the [Compile] button.

8. Click the [ABI] button to copy the contract’s ABI.

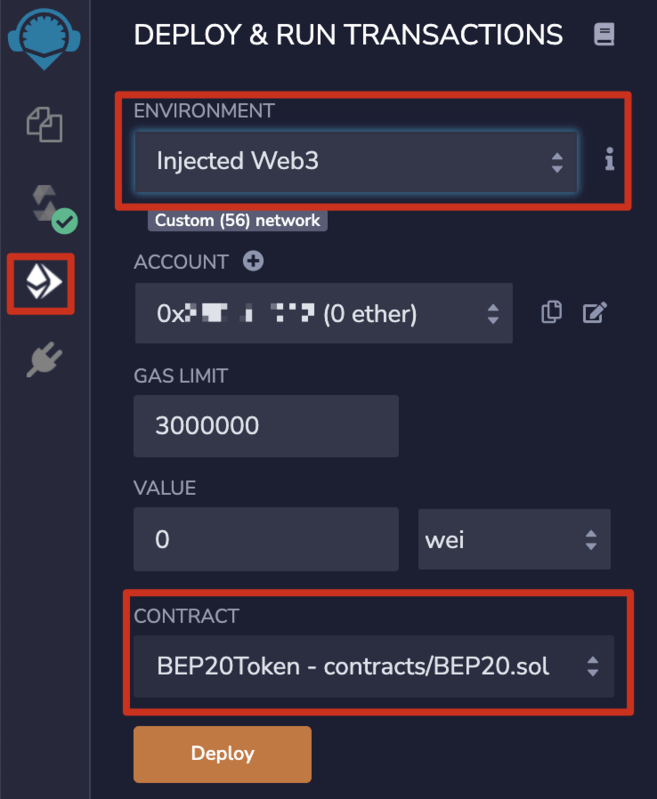

9. Click the icon highlighted below on the left-hand side of the screen. Select [Injected Web3] as your environment and then allow MetaMask to connect to Remix. Finally, make sure you’ve selected your BEP20 contract before clicking [Deploy].

10. You’ll now need to pay a transaction fee via MetaMask to deploy the contract to the blockchain. Once the smart contract is live, you need to verify and publish your contract source code.

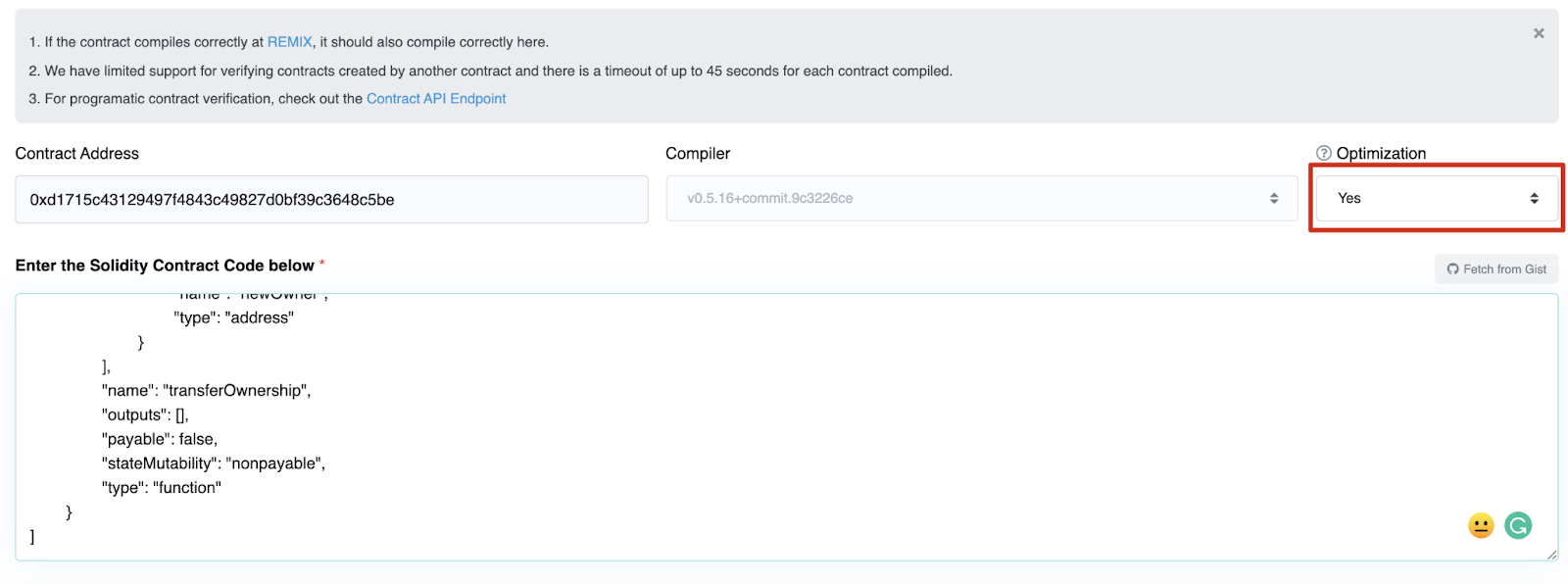

Copy in the contract’s address to BscScan, select [Solidity (Single)] as the compiler type, and match the compiler version used in step 7.

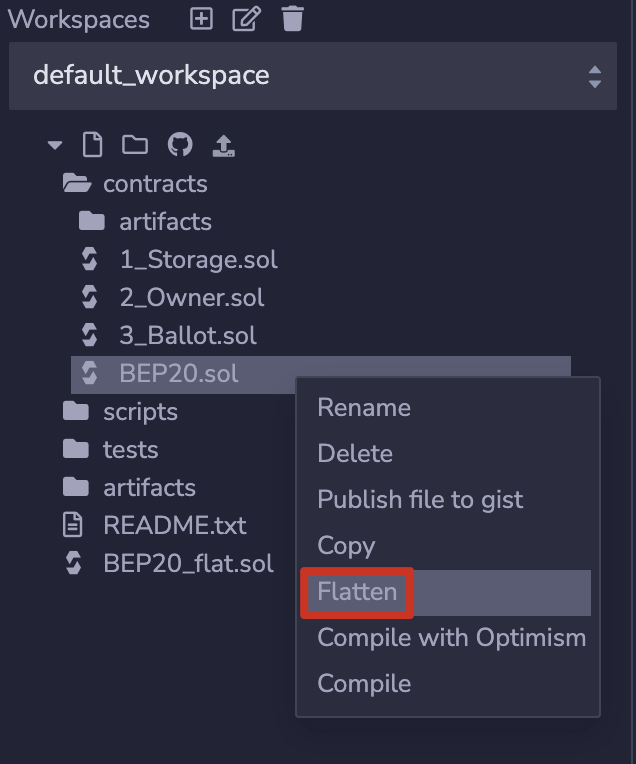

11. Next, right click BEP20.sol in Remix and press [Flatten]. You’ll then need to give Remix permission to flatten the code.

12. Copy the code from your BEP20_flat.sol into the field, and ensure [Optimization] is set to Yes. Now click [Verify and Publish] at the bottom of the page.

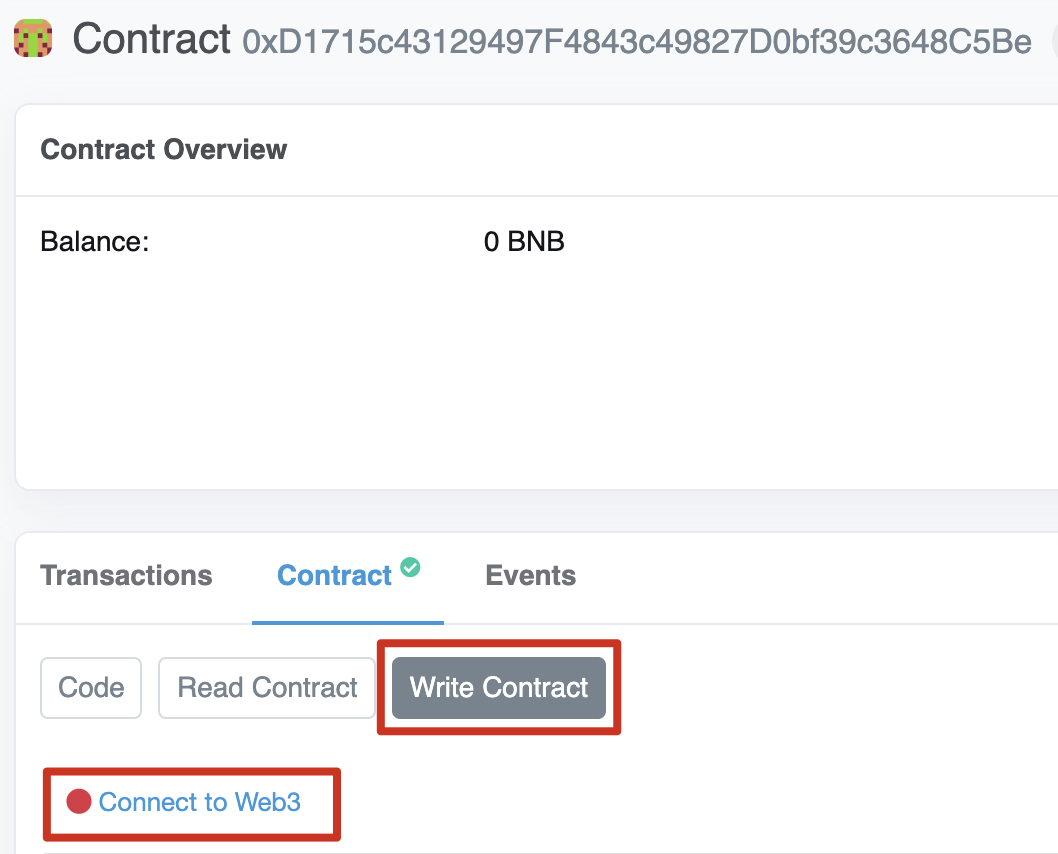

13. You’ll now see a successful splash screen. With the verified code, you can mint your token through BscScan by using the _mint call implemented in the contract. Go to the contract address on BscScan and click [Write Contract], then click [Connect to Web3] to connect your MetaMask account.

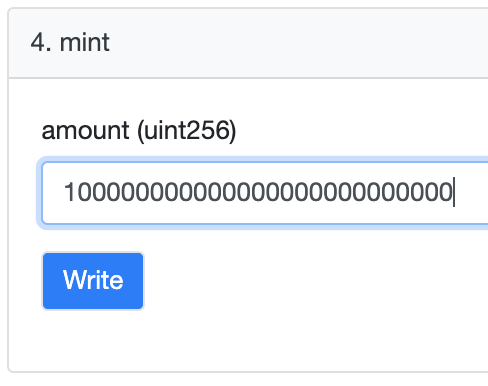

14. Head down the page to the Mint section, and input the number of tokens you want to mint. We’re going to mint 100,000,000 BAC. Don’t forget to add the decimals too, in this case 18. Click [Write] and pay the fee on MetaMask.

15. You should now see that the tokens have been minted and sent to the wallet that created the smart contract.

Getting your coin or token listed on a cryptocurrency exchange like Binance can introduce it to a broader audience in a safe and regulated way. If you manage to create and develop a solid cryptocurrency project, you can fill in Binance's online application forms for either a direct listing and/or distribution on Launchpad/Launchpool.

Every cryptocurrency goes through a rigorous due diligence process, and you'll need to update Binance regularly of your progress during the application. You'll also need to accept BNB and BUSD in your cryptocurrency's ecosystem, such as providing them as liquidity or accepting them during your initial coin offering (ICO) or token sale.

The costs involved are linked to the methods and setup you choose. If you're creating a coin and blockchain you'll likely have to pay a whole team over multiple months. A code audit from a reliable team can also cost around $15,000 (USD). At its cheapest, a simple token on BSC can be done for $50. When we average this out, to create a cryptocurrency with some chance of success, you'll likely need to spend thousands of dollars on its creation, marketing, and community building.

If you decide to make your own cryptocurrency, make sure to use our information only as a starting point. It's a deep topic that takes a long time to understand fully. Beyond creating the token or coin, you also need to think about making it a success post-launch. Studying other projects and their launches to see what worked well and what didn’t can help with creating your own cryptocurrency.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.