Let’s face it, who wouldn’t want investment advice from the richest genius in the Marvel Universe? This article will enrich you with tips that will help you invest in cryptocurrency like a superhero.

Introduction

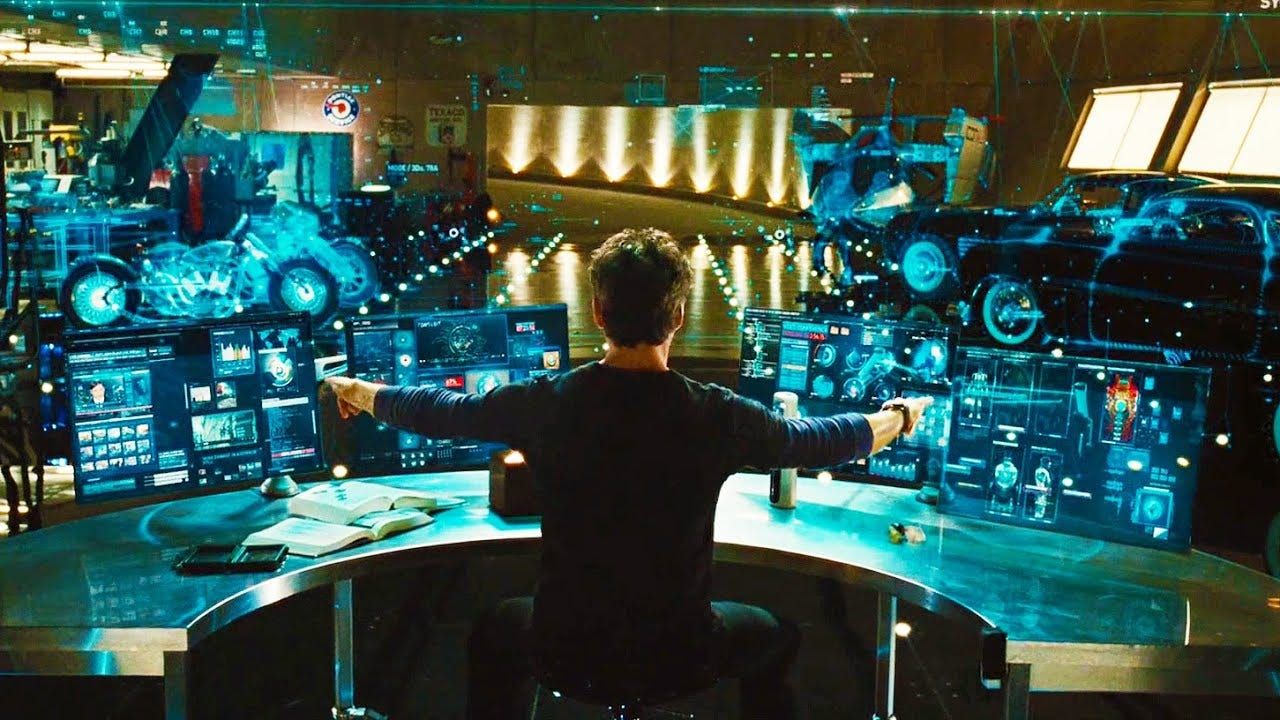

Ever wondered what it would be like to trade cryptocurrencies like Tony Stark, a.k.a Iron Man? While Tony Stark may be a fictional character, he is also a genius billionaire whose principles and strategies can offer real-world wisdom, especially in transforming your crypto investment game.

Let’s face it, who wouldn’t want investment advice from the richest genius in the Marvel Universe? Not you, right? Not me either!

This article will enrich you with tips that will help you invest in cryptocurrency like a superhero.

Let’s blast off!

1. Iron Man Wasn’t Afraid of Change:

Remember in the first Iron Man movie when Tony Stark built the first Iron Man suit in a cave with limited resources? That suit was bulky and cumbersome, but that was just the beginning. By Avengers: Endgame, his suit had evolved into an incredibly advanced piece of technology; a sleek nanotech suit that could do just about anything. That was the suit that was used to save the universe. His previous suits would have never achieved this feat. That is the power of innovating, adapting, and upgrading.

Cryptocurrency is one of the most innovative financial technologies of our time. Bitcoin, the first cryptocurrency, was introduced in 2009, and since then, we've seen a rapid evolution in the crypto space, just like the Iron Man suit. New cryptocurrencies, blockchain technologies, and decentralised finance (DeFi) platforms have been emerging regularly.

What can you take away from this? Just as Tony constantly upgraded his suit, you should constantly educate yourself and adapt to the latest developments in crypto.

2. Tony Stark’s Tech Made Him Invincible:

Tony Stark's success as Iron Man wasn't just about his genius; it was also about his tools. Tony Stark's suit was a marvel (pun intended) of engineering, packed with AI, advanced weapons, and other tech. J.A.R.V.I.S. and later, FRIDAY, were indispensable tools that helped him make decisions and take action. From the advanced AI system J.A.R.V.I.S. to the nanotechnology used in his later suits, Tony relied on cutting-edge technology to stay ahead.

Similarly, in the world of crypto trading, having the right tools can make all the difference. Use reputable crypto exchanges like Obiex for buying and selling cryptocurrencies. Leverage trading bots , market analysis tools, and secure wallets to enhance your trading efficiency and security.

In a nutshell, equip yourself with the best tools available to make informed decisions and protect your investments.

3. Tony Stark Was Always Patient and Resilient:

Tony Stark faced numerous failures - from his capture in Iron Man 1, his suit’s power poisoning him in Iron Man 2, forcing him to find a new element to survive, to half Earth’s population disappearing in Avengers: Infinity War. Despite these setbacks, he persevered and found solutions because his patience and resilience kept him going.

This type of patience is also vital in crypto. The crypto market can be a rollercoaster. Prices can skyrocket one day and plummet the next. It's easy to make mistakes, especially when starting. You might invest in a coin that crashes or fall victim to a scam. But, like Tony, it's important to learn from these failures and keep going.

Treat each mistake as a learning opportunity. Analyse what went wrong, adjust your strategy, and move forward.

4. Iron Man Was Never Satisfied Until He Diversified:

Remember when Iron Man ran into issues with his suit and had to switch them? In fact, Mark XLIII, the suit model Iron Man used in Avengers: Age of Ultron, was a combination of the best features from the Mark VII and Mark XLII, two of his previous armours, merging the versatility of the latter with the endurance of the former.

Tony Stark didn't rely on a single suit model. He created multiple versions, each designed for different scenarios. This diversity ensured he was always prepared for any situation.

In crypto investing, diversification is very important. Don't put all your money into one cryptocurrency. Spread your investments across different coins and tokens. This way, if one investment underperforms, others may perform well and balance out your portfolio. Consider a mix of established coins like Bitcoin and Ethereum, along with promising altcoins.

And never invest money you can't afford to lose. Just like Tony had backup plans, you should have strategies to minimise your risks, such as stop-loss orders to limit potential losses.

5. Iron Man Ensured His Endgame Had a Clear Exit Strategy:

In Avengers: Endgame, Tony Stark had a clear plan to defeat Thanos. He knew what he needed to do, when everything else went awry, even if it meant making the ultimate sacrifice. It would have been disastrous if Iron Man was clueless about the next step of action to take when he noticed that the end battle was turning against his team. Having a strategy and knowing the right moment to implement it was what contributed to his success.

Before you start investing, have a clear exit strategy. Decide when you will sell your assets. This could be when a cryptocurrency reaches a certain price or after holding it for a specific period. Having an exit strategy helps you avoid panic selling during market dips or getting greedy during peaks.

Set your goals and stick to them. Know when to exit a position to secure your profits or minimise losses.

6. Tony Stark Knew How to Stay Calm Under Pressure:

One of the conflicts Captain America had with Iron Man was that he was always “unbothered” during situations that could make anyone panic. To Captain America, this meant that Tony Stark didn’t care about any situation, no matter how dire it was. But was this the case?

Tony Stark faced numerous high-pressure situations. Whether battling villains or facing the potential end of the world, he remained calm and composed. But this was because taking this stance helped him make rational decisions under stress.

The crypto market can be highly stressful, with its constant fluctuations. It's easy to let emotions drive your decisions, but this can lead to mistakes like panic selling or impulsive buying.

Learn composure from Iron Man. Stay calm and stick to your strategy. Don't let short-term market movements influence your long-term plans. Use logic and data to make informed decisions.

7. Tony Stark Didn't Work Alone:

Even though Tony Stark was a genius, he knew the value of teamwork. That was why he founded The Avengers. He knew that collaboration was key and everyone needed to work with others to achieve their ultimate goals, and that was what eventually played out. The Avengers were able to accomplish what no individual could, including saving the world.

This is why you need to join communities as a crypto trader. In crypto investing, being part of a community can provide valuable insights and support. Join forums, social media groups, and local meetups. Share your experiences, learn from others, and collaborate on investment strategies. Collective wisdom can be a powerful tool.

Takeaway

Now, you understand what it means to trade like a superhero. You need to have solid principles and stick to them.

Trading cryptocurrency like Tony Stark means embracing innovation, using the right tools, learning from failures, diversifying your portfolio, having a clear exit strategy, and staying calm under pressure.

By applying these Iron Man principles, you can navigate the crypto world with confidence and potentially become a superhero in your own right. Happy trading!

FAQs

Q1. Who is Tony Stark, and why is he relevant to cryptocurrency investing?

A1. Tony Stark is a genius inventor and billionaire from the Marvel Universe, known for his analytical thinking, risk management, and innovative approach. These traits are relevant to successful cryptocurrency investing.

Q2. What are some of Tony Stark's principles that apply to cryptocurrency investing?

A2. Some key principles are innovation, risk management, strategic planning, adaptability, and resilience.

Q3. How can innovation help in cryptocurrency investing?

A3. Innovation in cryptocurrency investing involves staying updated with new coins, blockchain technologies, and market trends. This helps investors identify and capitalise on emerging opportunities.

Q4. What are the best practices for risk management in cryptocurrency investing?

A4. Best practices include diversifying your portfolio, setting stop-loss limits, avoiding over-leveraging, and conducting thorough research before investing.

Q5. Why is strategic planning important in cryptocurrency investing?

A5. Strategic planning helps investors set clear goals, establish a roadmap to achieve them, and maintain discipline. It ensures that decisions are based on strategy rather than emotions.

Q6. How can an investor develop a clear investment strategy?

A6. An investor can develop a clear strategy by defining their investment goals, risk tolerance, and time horizon. They should also conduct extensive research and continuously monitor and adjust their strategy as needed.

Q7. Is it necessary to be a technology expert to apply Tony Stark's principles to investing?

A7. While a deep understanding of technology can be beneficial, it is not necessary. What’s more important is a willingness to learn, adapt, and apply strategic thinking and risk management practices.

Q8. How can resilience be cultivated in cryptocurrency investing?

A8. You can achieve resilience by maintaining a long-term perspective, learning from mistakes, and not being discouraged by short-term losses.

Q9. Can you provide an example of how Tony Stark's resilience is relevant to investing?

A9. Tony Stark often faces setbacks but learns from them and improves his technology and strategies. Similarly, investors can learn from their investment failures, refine their strategies, and continue to improve their decision-making process.

Q10. Are there any specific tools or resources that can help apply Tony Stark's principles to cryptocurrency investing?

A10. Yes, tools like market analysis software, portfolio trackers, and educational resources on blockchain technology and market trends can help investors apply these principles effectively.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.