As Bitcoin approaches its fourth halving event in 2024, we take a closer look at its potential impact on the cryptocurrency landscape. Beyond the technical aspects, we investigate how this reduction in mining rewards may influence miners, investors, and the broader adoption of Bitcoin.

Understanding the Bitcoin Halving

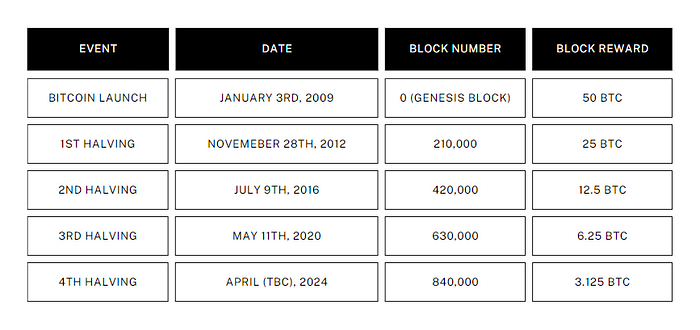

During a Bitcoin halving, often referred to as a ‘halvening,’ the reward granted to miners for validating transactions undergoes a 50% reduction. This cyclic event is slated to take place approximately every 210,000 blocks, translating to roughly a four-year interval. This process will persist until the Bitcoin network reaches its predetermined maximum supply of 21 million bitcoins. The deliberate reduction in new bitcoin issuance aims to manage the cryptocurrency’s supply, creating a sense of scarcity reminiscent of precious metals like gold.

Since its inception in 2009, Bitcoin has undergone three halving events, strategically designed to regulate its supply and manage inflation. The inaugural halving transpired on November 28, 2012, ushering in a reduction of the block reward from 50 BTC to 25 BTC. Subsequently, the second Bitcoin halving occurred on July 9, 2016, further diminishing the reward to 12.5 BTC. Most recently, on May 11, 2020, the third Bitcoin halving event unfolded, culminating in a reward decrease to 6.25 BTC. These meticulously timed events play a crucial role in shaping the economic landscape of Bitcoin by influencing its value dynamics over time.

When is it Happening?

In 2024, Bitcoin is poised to undergo its fourth halving on or around April 18th. This recurring event is designed to systematically reduce block rewards, with the process set to persist until the year 2140, culminating in a scenario where rewards reach zero.

Scarcity and Unique Aspects

The intentional scarcity created by these halving events significantly contributes to Bitcoin’s intrinsic appeal as a store of value, aligning with its conceptualization as a digital equivalent to precious metals. As the supply diminishes, Bitcoin’s scarcity narrative becomes increasingly prominent, reinforcing its position as a sought-after asset for those seeking a store of value in the ever-evolving landscape of digital currencies.

What sets this particular halving apart is its unprecedented impact on Bitcoin’s scarcity, a characteristic that has garnered attention and recognition. In a recent CNBC discussion on the impending halving event, Bitcoin was heralded as potentially becoming the first asset in history to surpass gold in terms of scarcity. The unique aspect highlighted was the projection that, on a relative basis, the event would result in the production of fewer new bitcoins through mining than the extraction of gold.

Bitcoin Halving Price History

Data Source: bitcoincharts.com; ChartsBTC

Why Does it Matter?

Examining the significance of the halving for the Bitcoin ecosystem reveals a cascade of effects that reverberate through various facets of the digital currency landscape.

Implications for Miners: The halving substantially impacts Bitcoin miners, who play a pivotal role in validating transactions and securing the network. As the block reward is halved, miners experience a direct reduction in their revenue. This event intensifies competition among miners, leading to increased operational efficiency and a focus on more sustainable and cost-effective mining practices. The economic adjustments within the mining sector contribute to the network’s overall health and resilience.

Implications for Investors: Investors closely monitor Bitcoin halving events due to their historical association with price movements. Past halving's have often preceded significant bullish trends in Bitcoin’s value. The reduction in the rate of new bitcoin issuance contributes to the cryptocurrency’s scarcity, potentially positioning it as a hedge against inflation. Investors may strategize around these dynamics, factoring the halving into their decision-making processes for portfolio allocation and risk management.

As we approach the 2024 Bitcoin halving, the cryptocurrency landscape anticipates another significant transformation. The reduction in mining rewards not only underscores the importance of scarcity but also poses challenges and opportunities for miners and investors alike. The recent approval of BTC spot ETFs this year adds a new element to the narrative. The introduction of these ETFs into the market has the potential to drive demand, attracting a new wave of institutional investors and further solidifying Bitcoin’s position in mainstream finance.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.