In recent times, if you've spent any time browsing Forex forums or engaging with social media, you've likely encountered discussions about Smart Money Concepts (SMC) trading.

You might be curious about what SMC entails and if it warrants the buzz surrounding it. In this article, we will present an overview of Smart Money Concepts trading, enabling you to make a well-informed choice about incorporating this approach into your trading repertoire.

What is SMC Forex trading?

A straightforward way to define Smart Money Concepts trading is by considering it as an alternative approach to price action.

SMC employs classic Forex principles such as supply and demand, price patterns, and support and resistance, but presents them under new names and with distinct descriptions.

Traders who use SMC refer to concepts like "liquidity grabs" and "mitigation blocks." Although the terminology might seem unfamiliar, upon closer examination, you'll find that SMC is more akin to traditional trading methods than it initially seems.

It's essential to note that there is nothing inherently wrong with utilizing SMC if it proves effective for an individual. However, we will critically analyze some aspects of SMC in this article, so please be prepared for that.

The theory behind SMC

Fundamentally, SMC asserts that market makers, such as banks and hedge funds, are manipulative entities deliberately making trading more challenging for retail traders.

As per the Smart Money Concepts approach, retail traders should base their strategies on the actions of the "smart money," which refers to the funds controlled by market makers.

The idea is to emulate the trading patterns of these market makers, focusing on aspects like supply, demand, and market structure. Therefore, as an SMC trader, you will pay close attention to these factors when making your trade decisions, aligning your approach with the sophisticated methods employed by influential market players.

By adopting this mindset and closely observing market maker behaviors, SMC traders strive to gain an edge in their trading, aiming to capitalize on the movements influenced by smart money.

So who invented SMC?

Smart Money Concepts can be traced back to The Inner Circle Trader (ICT), a program developed by a trader named Michael J. Huddleston. ICT provides a mix of free resources and paid Forex mentorship opportunities.

Huddleston's program aims to educate and support traders in understanding the inner workings of the Forex market, primarily focusing on the strategies and philosophies centered around smart money. By offering valuable insights, ICT empowers traders with the knowledge and confidence to navigate the often complex and volatile world of Forex trading. Through a combination of free materials and personalized mentorship, traders at various experience levels can benefit from the ICT approach to Smart Money Concepts.

In addition to ICT and Michael J. Huddleston, there are numerous other individuals and entities teaching Smart Money Concepts and other trading strategies online. The internet is home to a vast array of resources, including blogs, forums, webinars, YouTube channels, and online courses, where traders can find information on various trading techniques.

However, it's essential for traders to exercise caution when choosing their educational sources. Not all content providers are equally credible, and some may even promote misleading or ineffective strategies. Therefore, conducting thorough research and cross-referencing multiple sources is highly recommended to ensure that the information being absorbed is reliable and valuable in building a solid foundation for trading success.

SMC concepts and terminology

SMC can indeed appear quite technical when you first encounter it, and the unique vocabulary might leave you puzzled. To help clarify things, here are explanations of some common terms used by SMC traders:

Order blocks: This term is employed to discuss supply and demand. Some SMC traders claim that order blocks are a more "refined" concept than regular supply and demand, but this view is not universally accepted.

Breaker blocks and mitigation blocks/flip zones: These phrases refer to order blocks that has been flipped. You can compare it to break and retest zones.

Fair value gaps: This term describes an imbalance in the market. It occurs when a Price leaves a specific level where there's less trading activity seen and only has a one-directional price movement.

Liquidity: this is a really important part of SMC.

Liquidity refers to specific price points where orders accumulate in the market, making an asset class "liquid." In other words, there are readily available orders at those prices, poised for transactions. It comes in various ways: highs and lows, equal highs/ lows, trend line liquidity. Liquidity is everywhere. Download our liquidity finder here.

Once you become familiar with the terminology, you'll realize that many SMC concepts are quite similar to conventional trading ideas.

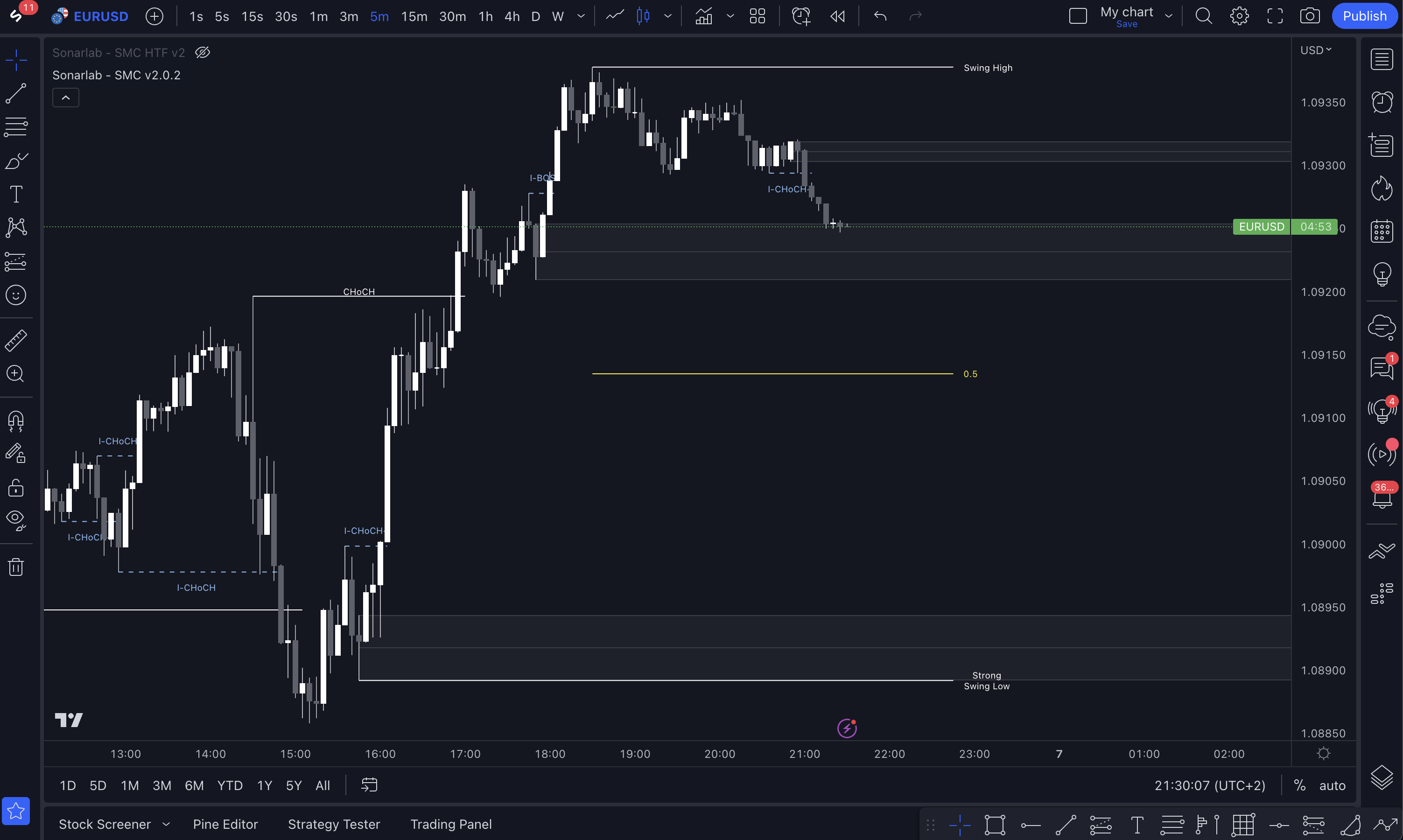

A key aspect of market analysis in SMC is the focus on "break of structure" (BOS) in the market

For example, in a chart illustrating breaks of structure, every time the price surpasses the previous high, a break of structure occurs. This is followed by a change of character (ChoCH) when the price drops down past previously established lows. By recognizing and understanding these patterns, SMC traders aim to make informed decisions based on the market's behavior. Other traders map this out with: higher high (HH), Higher low (HL), lower low (LL), and lower high (LH)

SMC is not trading like the banks and institutions

In simpler terms, SMC traders are not actually trading like banks or large market participants. Instead, their approach is just a perspective or interpretation of how they believe these big players might trade. This viewpoint helps SMC traders make sense of market movements and develop strategies, but it doesn't guarantee that they are truly emulating the actions of banks and other major market makers.

It's important to understand that in any market, for every buyer, there must be a seller, and vice versa. Liquidations and market fluctuations are indeed real occurrences. SMC is a theory that has proven effective for many traders, and its underlying principles are solidly grounded in logic. The key to its success lies in its interpretation of market movements and understanding of how large market participants potentially influence the market. While SMC may not perfectly mirror the actions of banks and major market makers, it provides traders with valuable insights and a framework to develop strategies that work well for their individual trading style.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.